Irs Hsa Eligible Expenses 2024. Subscribe to kiplinger’s personal finance. Are you eligible for the saver's credit?

An hsa is a savings account for health expenses that offers tax advantages. Those 55 and older can contribute an additional $1,000 as a.

Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

8, 2023 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that.

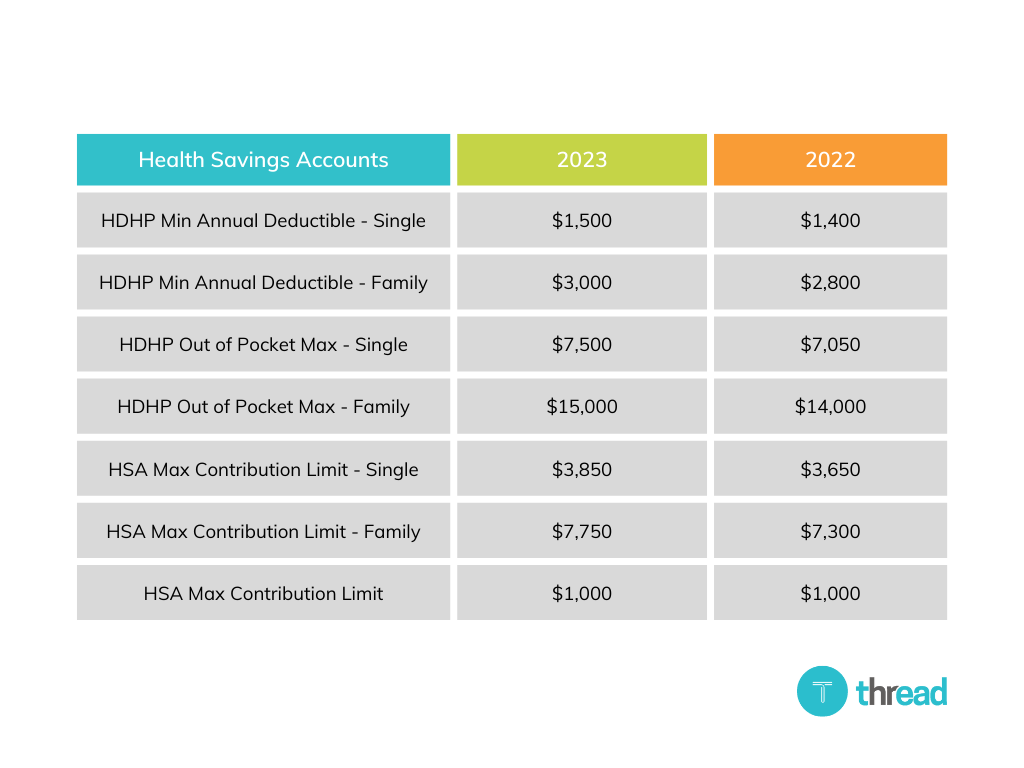

2024 HSA & HDHP Limits, The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. The annual hsa contribution limits under section 223 (b) (2) for 2024 will be:

How to SetUp & Get the Most from a Health Savings Account (HSA), A health savings account lets you save money for various healthcare expenses. Hsas are a type of account you can open if you have a health insurance deductible above a certain threshold — $1,600 for individuals in 2024 — and want to.

Significant HSA Contribution Limit Increase for 2024, A health savings account lets you save money for various healthcare expenses. Those 55 and older can contribute an additional $1,000 as a.

IRS Announces HSA Limits for 2024 Paysmart, Are you eligible for the saver's credit? 8, 2023 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that.

IRS Issues 2024 HSA and EBHRA Limits Innovative Benefit Planning, The annual limit on hsa. Always check with your hsa plan.

IRS Health Savings Account Adjusted Amounts for 2023 Total Benefit, Always check with your hsa plan. Subscribe to kiplinger’s personal finance.

HSA Eligible Expense List, The maximum credit you could earn is $1,000 if you are. That’s $10,500 worth of qualifying medical expenses ($15,000 minus $4,500).

Hsa Limits 2024 Rycca Clemence, For 2024, a person can contribute up to $4,150 in an hsa, up from $3,850 this year, the irs said this week. If the credit brings what you owe to the irs to $0, you.

IRS Announces 2023 HSA Contribution Limits, Are you eligible for the saver's credit? If the credit brings what you owe to the irs to $0, you.

IRS HSA Eligible Expenses, For 2024, a person can contribute up to $4,150 in an hsa, up from $3,850 this year, the irs said this week. The annual hsa contribution limits under section 223 (b) (2) for 2024 will be:

So, the parent (your employee) could have an hsa and contribute the allowed maximum family contribution of $7,300 and the dependent adult child could contribute.